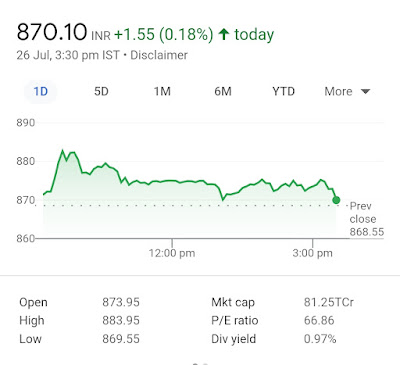

Last Updated: Wednesday, July 26, 2023

Unveiling the Brew-tiful Potential of Tata Consumer Products - A Multibagger Stock Worth Considering

Last Updated: Sunday, April 16, 2023

Why Gujarat Ambuja Exports Ltd is a Solid Bet for Multibagger Returns!

Why Gujarat Ambuja Exports Ltd is a Solid Bet for Multibagger Returns!

Discover the multibagger potential of Gujarat Ambuja Exports Ltd, a promising small cap stock in the agro-processing sector. Learn about its diverse product portfolio, robust financials, and strategic growth initiatives that make it a compelling investment opportunity for 2023-2025.

Gujarat

Ambuja Exports Ltd (GAEL) has emerged as a potential small cap multibagger

share, attracting the attention of investors seeking exponential returns. As a

debt-free company with a diverse product portfolio, including Corn Starch

Derivatives, Soya Derivatives, Feed Ingredients, Cotton Yarn, and Edible Oils,

GAEL is well-positioned for growth in the agro-processing sector. The company's

solid financial performance and efficient capital utilization have led market

analysts to set optimistic share price targets for 2023 and 2025.

Unlocking the Potential of Gujarat Ambuja Exports Ltd: A Small Cap Multibagger Share to Watch in 2023-2025

In

recent news, Gujarat Ambuja Exports has been exploring opportunities in the

ethanol industry, further diversifying its product offerings and strengthening

its market position. This latest development adds to the company's appeal as a

promising investment opportunity. Investors can track GAEL's share price using

stock screeners to stay updated on its performance and make informed decisions.

Owned

by the Gujarat Ambuja Group, GAEL continues to make headlines for its strategic

moves and growth initiatives. The company's commitment to innovation and

expansion, coupled with its robust financials, make it a compelling choice for

those seeking a multibagger stock with strong potential for appreciation in the

coming years. Keep an eye on GAEL's latest news and developments to stay ahead

of the curve and make the most of this investment opportunity.

Top of Form

The search for a multibagger stock is every investor's dream, and Gujarat Ambuja Exports Ltd (GAEL) appears to be a promising candidate. With its diverse portfolio, strong fundamentals, and impressive financial performance, GAEL seems well-positioned to deliver exponential returns in the coming years.

"Gujarat Ambuja Exports Ltd: The Small Cap Gem Poised for Multibagger Growth in the Agro-Processing Sector"

Here

are the essential reasons why Gujarat Ambuja Exports Ltd, with a current market

price (CMP) of ₹266

[As of 13th April, 2023], is a solid bet for multibagger

returns:

1.

Diversified

Business Portfolio: GAEL is engaged in

the manufacturing of Corn Starch Derivatives, Soya Derivatives, Feed

Ingredients, Cotton Yarn, and Edible Oils. This diversified product portfolio

ensures that the company is less vulnerable to industry-specific risks and can

cater to various sectors such as Food, Pharmaceutical, and Feed industries.

2.

Strong

Financial Performance: GAEL has shown

remarkable financial performance, with an exceptional return on equity (ROE) of

25% and a healthy pre-tax margin of 14%. The company is also debt-free, which

is a strong indicator of financial stability and paves the way for sustainable

earnings growth.

3.

Robust

Operating Metrics: The company's

return on capital employed (ROCE) is an impressive 30.4%, indicating efficient

use of capital in generating profits. The cash conversion cycle is also

favorable, reflecting the company's effective management of working capital.

4.

Growth

Potential in Agro-Processing Sector:

GAEL is strategically positioned in the agro-processing sector, which is poised

for significant growth in the coming years. With increasing demand for

processed foods, pharmaceuticals, and animal feed, GAEL's product offerings are

well-aligned with market needs, enabling the company to capitalize on emerging

opportunities.

5.

Attractive

Valuation: GAEL's stock is currently

trading at a price-to-earnings (P/E) ratio of 14.7, which is relatively

attractive compared to industry peers. The stock also has a healthy dividend

yield of 0.24%, rewarding investors with regular income.

6.

Technical

Outlook: Though the stock is currently

trading below its key moving averages, a break above these levels could trigger

a bullish trend, leading to significant price appreciation.

"Discovering the Multibagger Potential of Gujarat

Ambuja Exports Ltd: A Small Cap Powerhouse in the Making"

- Expansion

Plans and Investments: GAEL

has demonstrated a consistent focus on expanding its capacity and

enhancing its product offerings. The company's investments in fixed

assets, current work-in-progress projects, and other assets have grown

over the years, highlighting its commitment to long-term growth. These

investments will likely enable GAEL to capture a larger market share and

improve its competitive position.

- Strong

Management and Corporate Governance: GAEL's management team has a proven track record of steering the

company towards growth and profitability. They have consistently made

strategic decisions that have positioned the company for success in the

agro-processing sector. Moreover, GAEL's commitment to strong corporate

governance practices ensures the interests of all stakeholders are

protected and fosters investor confidence.

- Increasing

Demand for Eco-Friendly and Sustainable Products: With a growing global emphasis on sustainability

and eco-friendly practices, the demand for products derived from renewable

sources like corn and soy is set to increase. GAEL, with its focus on such

products, is well-positioned to benefit from this trend and cater to the evolving

preferences of consumers and industries alike.

- Government

Support and Policies: The

Indian government has been actively promoting the agro-processing sector,

recognizing its potential to drive economic growth and employment. Various

policy measures, such as infrastructure development, tax incentives, and

financial support, have been introduced to encourage investments in this

sector. GAEL, as a key player in the agro-processing industry, is poised

to benefit from these supportive government policies and initiatives.

- Favorable

Industry Tailwinds: The

global agro-processing sector is expected to witness strong growth in the

coming years, driven by factors such as population growth, urbanization,

rising disposable incomes, and changing consumer preferences. As a result,

the demand for GAEL's products is likely to increase, enabling the company

to achieve robust revenue and profit growth.

- Resilience during Business Cycles: GAEL's strong balance sheet, debt-free status, and diverse product portfolio enable it to weather business cycles effectively. This resilience bodes well for the company's long-term prospects and ensures that it can continue to deliver stable earnings growth, even in challenging market conditions.

"Investing in the Future: Why Gujarat Ambuja Exports Ltd is Your Ticket to Multibagger Returns"

Taking

these factors into account, Gujarat Ambuja Exports Ltd emerges as an excellent

investment opportunity for those seeking multibagger returns. With its diverse

product portfolio, strong financials, growth potential, and favorable industry

dynamics, GAEL is poised for significant value creation in the coming years. In

conclusion, Gujarat Ambuja Exports Ltd's diversified business model, strong

financial performance, growth potential, and attractive valuations make it a

compelling investment for those seeking multibagger returns. Investors with a

long-term perspective should consider adding GAEL to their portfolios and

capitalize on the company's promising growth trajectory.

"Seizing the Opportunity: Gujarat Ambuja Exports Ltd as the Ultimate Small Cap Multibagger Share for 2023-2025"

Understanding

the Matrics;

Here

are the key findings that can help investors make an informed decision about

investing in Gujarat Ambuja Exports Ltd:

- Market

Capitalization: The company

has a market capitalization of ₹6,090 Cr, which indicates that it is a

mid-cap stock. Mid-cap stocks generally provide a balance between growth

and stability, offering potential for higher returns compared to large-cap

stocks while having lower volatility compared to small-cap stocks.

- Stock Price

Performance: The stock

has traded in a range of ₹394 (52-week high) to ₹215 (52-week low), with

the current price at ₹266. This indicates that the stock is trading closer

to its 52-week low, presenting a potential buying opportunity for investors.

- Valuation

Ratios: The stock

has a Price-to-Earnings (P/E) ratio of 14.7 and a Book Value of ₹99.9. The

P/E ratio is relatively attractive compared to industry peers, suggesting

that the stock may be undervalued. The Book Value provides a measure of

the company's net worth, and a higher Book Value is generally considered

favorable.

- Dividend

Yield: The company offers a

dividend yield of 0.24%, providing investors with a modest income stream

in addition to potential capital appreciation.

- Return on

Capital Employed (ROCE) and Return on Equity (ROE): The company's ROCE is 30.4%, while its ROE is

25.0%. These figures indicate efficient utilization of capital and

above-average profitability compared to industry peers.

- Debt-Free

Status: GAEL is a

debt-free company, which indicates a strong financial position and lowers

the risk associated with high debt levels.

- Operating

Revenue and Profit Margins: The company has an operating revenue of ₹4,844.12 Cr on a trailing

12-month basis, with an annual revenue de-growth of 0%. Although revenue

growth needs improvement, GAEL's pre-tax margin of 14% is healthy, and its

ROE of 22% is exceptional.

- Business

Overview: GAEL

operates in the agro-processing sector, manufacturing a diverse range of

products, including Corn Starch Derivatives, Soya Derivatives, Feed

Ingredients, Cotton Yarn, and Edible Oils. This diversification helps

mitigate risks associated with any single industry or product segment.

- Financial

Performance: The

company's sales, net profit, and earnings per share (EPS) have shown

growth over the years, indicating a strong financial performance. The

recent decline in sales growth and EPS can be seen as a potential area for

improvement.

- Cash Flow

Management: The company

has demonstrated positive cash flow from operating activities, which is

essential for funding business growth and paying dividends to

shareholders.

The key findings suggest that Gujarat Ambuja Exports Ltd is a

fundamentally strong company with an attractive valuation and potential for

growth in the agro-processing sector. Investors considering adding GAEL to

their portfolio should weigh these findings against their investment

objectives, risk tolerance, and the overall market conditions before making a

decision.

Top of Form

Gujarat Ambuja Exports Ltd stands out as a promising small cap stock with strong multibagger potential. Its diverse product offerings, debt-free status, and impressive financial performance make it an attractive investment opportunity for those seeking exponential returns in the coming years. As the company continues to explore new avenues for growth, such as the ethanol industry, investors should keep an eye on the latest news and developments to stay ahead of the curve. Don't miss out on this exceptional investment opportunity, as Gujarat Ambuja Exports Ltd could very well be the key to unlocking significant wealth in the agro-processing sector.

Last Updated: Saturday, April 15, 2023

Tax Saving Investment Options: ELSS, PPF, NPS and More

Explore various tax-saving investment options in India, including ELSS, PPF, NPS, and more. Learn the benefits, features, and eligibility criteria to make well-informed investment decisions.

"Discover

the best tax-saving investment options in India, including ELSS, PPF, NPS, SSY,

and more, to help you maximize your savings and build a secure financial

future. Our comprehensive guide covers everything from the benefits of

Equity-Linked Saving Schemes and Public Provident Funds to the features of

National Pension System and Sukanya Samriddhi Yojana. Additionally, learn about

insurance policies, ULIPs, and other Section 80C investments that can help you

save tax while achieving your financial goals. Stay ahead in the world of

personal finance by making well-informed investment decisions with our expert

insights and guidance."

Tax

Saving Investment Options: ELSS, PPF, NPS and More

Saving

tax is a crucial aspect of financial planning, and India offers numerous

investment options to help investors save tax while also growing their wealth.

In this post, we will discuss the popular tax-saving investment options, such

as Equity-Linked Saving Scheme (ELSS), Public Provident Fund (PPF), National

Pension System (NPS), and more. By understanding the benefits, features, and

eligibility criteria of these instruments, you can make informed decisions that

align with your financial goals and risk appetite.

1.

Equity-Linked

Saving Scheme (ELSS)

ELSS

is a type of diversified equity mutual fund that qualifies for tax deductions

under Section 80C of the Income Tax Act. These funds invest primarily in equity

and equity-related instruments, offering the potential for higher returns

compared to other tax-saving options.

a.

Lock-in Period: ELSS has a

lock-in period of three years, making it a relatively more liquid option among

tax-saving investments.

b.

Tax Benefits: Investments in

ELSS qualify for tax deductions up to ₹1.5 lakh per financial year under

Section 80C.

c.

Risk Profile: As ELSS funds

invest in equities, they carry a higher risk compared to debt-oriented

tax-saving instruments. However, they also offer the potential for higher

returns in the long run.

2.

Public

Provident Fund (PPF)

PPF

is a long-term, government-backed savings scheme that offers tax benefits and a

secure, fixed return on investment.

a.

Lock-in Period: PPF has a lock-in

period of 15 years, with the option to extend the account in blocks of five

years after maturity.

b.

Tax Benefits: Investments in

PPF are eligible for tax deductions up to ₹1.5 lakh per financial year under

Section 80C. The interest earned and the maturity amount are also tax-exempt.

c.

Risk Profile: PPF is a low-risk

investment option, as it is backed by the government and offers a guaranteed,

fixed interest rate.

3.

National

Pension System (NPS)

NPS

is a voluntary, government-backed pension scheme aimed at providing financial

security during retirement. It invests in a mix of equity, corporate bonds, and

government securities.

a.

Lock-in Period: NPS has a lock-in

period until the investor reaches the age of 60, with a minimum of 10 years of

contribution.

b.

Tax Benefits: Investments in

NPS qualify for tax deductions up to ₹1.5 lakh per financial year under Section

80C. Additionally, an exclusive deduction of ₹50,000 is available under Section

80CCD(1B).

c.

Risk Profile: The risk profile

of NPS depends on the chosen investment mix, with options ranging from

conservative to aggressive.

4.

Other

Tax-Saving Investment Options

Apart

from ELSS, PPF, and NPS, there are several other tax-saving investment options

to consider:

a.

5-Year Tax-Saving Fixed Deposits:

Offered by banks, these fixed deposits qualify for tax deductions under Section

80C, with a lock-in period of five years.

b.

Life Insurance Policies: Premiums

paid towards life insurance policies, including term plans, endowment plans,

and Unit-Linked Insurance Plans (ULIPs), are eligible for tax deductions under

Section 80C.

Keywords:

Tax Saving Investment Options, ELSS, PPF, NPS, SSY, Sukanya Samriddhi Yojana,

LIC, insurance, ULIP, 80C investments.

Last Updated: Monday, August 2, 2021

Jindal Saw Stock Idea : INTEGRATED INFRASTRUCTURE PROXY

JINDAL SAW: FULLY INTEGRATED INFRASTRUCTURE PROXY

- Jindal Saw is the only company in the world that provides Total Pipe Solutions

- Jindal Saw is 2nd largest Pipe exporter in Asia Pacific region

- It is 3rd largest producer of DI Pipes in the world

- Jindal Saw has shown a big margin expansion aided by Higher Realisation.

Stock is bullish after Spectacular Q1 Results

▪️ Volumes at 0.62 MT vs 0.39 MT (+59% YoY)

▪️ Realisation/T came at 38740 cr vs 34214cr (+13.2% YoY)

▪️ Revenue at 2417cr vs 1346cr (+80% YoY)

▪️ EBIDTA at 355cr vs 151cr (+135% YoY)

▪️ EBITDA Margin came at 14.7% vs 11.2% (+350bps YoY)

▪️ PAT at 146cr vs loss of 27cr

▪️ EPS of 4.78 vs (0.29)

- Saw Pipes

- Ductile Iron Pipes & Fittings

- Carbon, Alloy,

- Stainless Steel Pipes & Tubes

- Pellets

Hindustan Oil (HOEC) is Ready to Fly

Hindustan Oil Set to Turn a Discovered Small Field (DSF-III) Success Story

HOEC is expected to start production from the block during the third quarter of the current financial year. The Company is seeing a ten-fold rise in the reserves based on the latest estimates.

The story of HOEC begins in 1983, when the great visionary, the Late Shri H.T. Parekh foresaw the need for a private stake in India's Oil & Gas sector. After over 3 decades, HOEC has now emerged as a fast growing independent E&P operator in India. HOEC now, through its operations, supplies 10,000 boe of products to the nation daily, across 4 of the 7 production basins in India. HOEC Ltd achieved it's success by adopting a low-cost rapid development model with a focus on local content, innovation and sustainable practices. HOEC aims to create long-term stakeholder value and ensures "grow responsibly".

Multiple keys to turn a Multibagger Stock

It is at a time when the majority of players, who won blocks under the DSF, are struggling to start production. A total of 54 contract areas were awarded in the first two rounds of DSF, out of which the DGH has received field development plans for 29 areas.

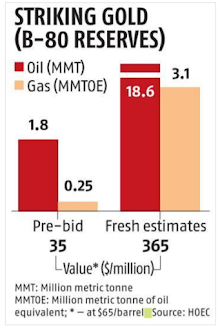

“We are seeing a multifold rise in the reserves based on the latest estimates. The pre-bid expected volume was around 1.8 million metric tonnne (MT) of oil and 0.25 million metric tonne of oil equivalent (MMTOE) gas. This has increased to 18.6 MT and 3.1 MMTOE now,” said P Elango, managing director (MD) of the company.

According to the company, with the rise in estimates, the value of reserves also increased from $35 million pre-bid to $365 million now (at a price of $65 a barrel). The company is investing $40 million in the block for two wells, in addition to four wells already drilled by the Oil and Natural Gas Corporation (ONGC).

“The reason for such increase is on account of post-development drilling, whereby HOEC revised the B80 three- dimensional geological model by applying all the data from the field, which include all the six wells,” he added.

B80 block in the Arabian Sea, off the Mumbai coast, had its first discovery by ONGC in 1987. HOEC won the block in September 2017, when the government came out with small field auctions to attract new investors to the sector. These were small oil and gas discoveries made by public sector undertaking oil companies, ONGC and Oil India (OIL). But these state-run companies could not develop it due to various reasons, including unviability, small size and restrictive fiscal regimes.

Though HOEC and Adbhoot Estates had equal stake in B80 initially, the Chennai-based company increased its stake to 60 per cent last year. The company had raised a Rs. 150-crore loan during that time for the acquisition and other project development works. The third round for which the government is scouting for investors includes 32 contract areas.

These comprise 75 discoveries, spread over 9 sedimentary basins covering an area of about 13,685 square kilometres. These blocks are expected to have a potential of approximately 232 million tonne. The government is set to conduct roadshows at overseas destinations like Perth, Singapore, Houston and London as well as domestic locations like New Delhi, Mumbai and Gandhi Nagar, said sources.

HOEC: Highlights

| |||||

| 52 Week High | 173.40 | ||||

| 52 Week Low | 60.35 |

| TTM EPS | 4.04 |

| TTM PE | 41.83 |

| Sector PE | 12.93 |

| Book Value Per Share | 55.44 |

| P/B | 3.05 |

| Face Value | 10 |

- Stock Price of HOEC is quoting at Rs. 150.90 at NSE on EOD 02-08-2021.

- Market Gurus believe that Hind Oil Exploration (HOEC) is still great buy after a decent rally in last week.

- Backed by lowest cost evacuation of crude the stock is poised to trade outside its chart territory.

- Glorious margins coming.

- If crude don't fall below 50 dollars, stock price is possible to give multibagger return to its stockholders in next two years.

Top Search keywords; HOEC;

hoec share price target, ongc share price, hoec share price nse, hindoilexp share price, hindustan oil exploration rakesh jhunjhunwala, hindustan oil share price forecast, hoec multibagger, hoec stock price latest news, hoec share price investment idea, hoec intraday price target, hoec hidden gem, hoec trading idea, hoec share price 52 week high low, hoec shareholding pattern, hoec stock ideas, hoec money n business, is hoec a multibagger stock.

Disclaimer; the above post is based on information available across internet, it is just a compilation of different reports. This post should be treated as an informational post only and it is not a buying call. Please consult your financial adviser before investing in the stock discussed in the post.

Last Updated: Sunday, January 26, 2020

Butterfly Gandhimati a multibagger in making

Industry: Electronics/Appliances

Butterfly Gandhimathi Appliances Ltd. engages in manufacture of household appliances. Its products include mixer grinder, LPG stove, pressure cooker, table top wet grinder, water heater, electric fans, air coolers, electric iron, and others. The company was founded on February 24, 1986 and is headquartered in Chennai, India.

Last Updated: Monday, July 9, 2018

ICICI maintains BUY rating on the NCL Industries, Target 210

Buy NCL Industries for a target price of Rs 210

About NCL Industries

Fundamental Analysis of NCL Industries Ltd find here>>>

Latest Shareholding pattern of NCL Industries Limited

Jul 06, 2018: Buy NCL Industries; target of Rs 210: ICICI Direct

Dec 13, 2017: Buy NCL Industries; target of Rs 305: ICICI Direct

Mar 15, 2017: Buy NCL Industries; target of Rs 265: Dolat Capital

Feb 28, 2012: Buy NCL Industries; target Rs 90: Auctus Capital

Dec 03, 2007: Buy NCL Ind; target of Rs 120: IL&FS Investsmart

Last Updated: Thursday, February 22, 2018

Chennai Petroleum: Buy This Multibagger Stock

Stock Idea; Chennai Petroleum Corporation Limited (CPCL)

- LPG,

- High Speed Diesel,

- Motor Spirit,

- Bitumen,

- Lube Base Stocks,

- Superior Kerosene,

- Aviation Turbine Fuel,

- Naphtha,

- Paraffin Wax,

- Hexane,

- Petrochemical Feed Stocks and

- Fuel Oil.

(In Rs Cr)

Total Share Capital

|

1,149.00

|

Net Worth

|

4,441.10

|

Total Debt

|

4,497.72

|

Net Block

|

3,882.83

|

Investments

|

140.00

|

Total Assets

|

8,938.81

|

SCHEME

|

NO.

OF SHARES

|

Aditya Birla Sun Life Bal. 95 Fund (G)

|

1,963,018

|

Aditya Birla Sun Life Pure Value Fund (G)

|

1,389,428

|

Aditya Birla Sun Life Small and Midcap Fund

|

681,710

|

Aditya Birla Sun Life Frontline Equity Fund

|

313,295

|