Tata Consumer Products Limited (TCPL) Share latest news:

Hey there, fellow investors!

Today, we're going to take a closer look at the recent performance of Tata Consumer Products (TCPL), the Indian FMCG major, and discover why it might be the perfect blend for your investment portfolio. With its latest financial results for the June quarter of FY24, TCPL has shown impressive growth that has the potential to make it a valuable asset for value investors in the large-cap market. TCPL seems to the best FMCG stocks to buy now for longterm investment. The stock has already given multibagger return and still has potential to be next larg cap multibagger stock.

TCPL's Thriving Q1 Performance:

In the first quarter of FY24, TCPL reported a consolidated net profit of Rs 358.57 crore, marking a significant 29 percent growth compared to the same period last year. The group net profit also surged by 22 percent to Rs 338 Crores. The company's ability to register consistent profit growth, quarter after quarter, is undoubtedly a positive sign for long-term investors.

Revenue Growth and Diverse Business Segments:

TCPL's total revenue for the quarter stood at Rs 3741.21 crore, an impressive 12.45 percent rise from the year-ago quarter. This exceptional growth can be attributed to the solid performance of its India business, which saw a remarkable 16 percent rise. Moreover, the international and non-branded businesses also contributed positively, growing by 3 percent and 5 percent (constant currency), respectively.

Key Drivers of Success:

TCPL's India packaged beverages business and India foods business were the star performers during the quarter, displaying revenue growth rates of 2 percent and 24 percent, respectively. The company's popular tea brands, Tata Tea Premium and Tata Tea Agni, led the charge with strong volume growth. Additionally, the coffee segment showed impressive revenue growth of 21 percent YoY.

NourishCo, TCPL's RTD business, recorded a whopping 60 percent revenue growth despite facing adverse weather conditions. Tata Soulfull, with its exciting new launches and entry into new categories, expanded its Total Addressable Market and continues to be a strong performer.

Embracing Innovation:

TCPL's commitment to innovation shines through, as the company maintained an innovation-to-sales ratio of 5 percent during Q1. This strategic focus on innovation fuels the company's growth and ability to stay ahead of the competition.

Strong Global Presence:

Not only is TCPL thriving in the domestic market, but its brands in the UK, including Tetley, Good Earth, and teapigs, also gained value market share in the last quarter. Additionally, Tata Starbucks recorded an impressive revenue growth of 21 percent, showcasing the company's international success.

Looking Ahead:

With the Q1 results exceeding market estimates, TCPL has showcased its resilience and potential as a multibagger stock for long-term investors. The company's expansion into new markets, consistent profit growth, and strong portfolio of popular brands make it an attractive proposition for value investors in the large-cap space.

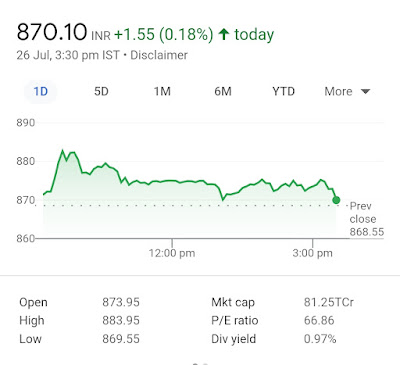

Tata Consumer Products Limited share price Target

Brokerage Citi has assigned a target price of Rs 1020 to the Tata Consumer products ltd's stock. Citi has initiated coverage of the stock with a buy call.

"We value Tata Consumer on a SoTP-based approach given different stages of growth/profitability across segments. Our Rs 1,020 target price implies a multiple of 56x Mar-25E, 5% premium to the stock's 3-year historical avg. Market share gains and premiumisation in core categories, increasing salience of new categories and improving financial metrics could keep absolute multiples elevated. Our picking in India staples is now Hindustan Unilever, Godrej Consumer and Tata Consumer," said Citi.

Conclusion:

So there you have it, folks! Tata Consumer Products has proven itself as a strong contender in the FMCG sector, exhibiting robust growth and resilience in the face of challenges. As an investor, TCPL's performance, coupled with its strategic focus on innovation and diverse business segments, makes it a compelling choice for your long-term investment goals. Remember, though investments carry inherent risks, this potential multibagger stock presents an enticing opportunity worth considering.

Disclaimer: This blog post does not constitute financial advice. Always conduct thorough research and consult with a financial advisor before making investment decisions. Happy investing!

No comments:

Post a Comment