NSE: ATULAUTO - 21 Oct, 3:30 PM IST CMP 478.20 INR

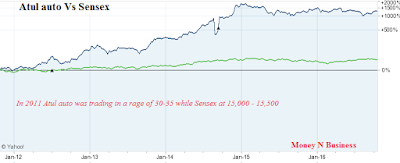

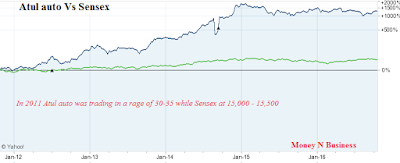

Atul Auto Ltd already a multibagger stock has always been darling of investors; it has

given tremendous return to its investors. Atul Auto’s shares jumped more

than 1,000 percent during 2011 to 2016 (up to 1382 percent), now shareholders

are excited to see how fast it reaches four digit marks. Atul Auto Ltd

has the unique privilege of being called a "Potential 100 bagger

stock" in the study of Motilal Oswal's 19th Wealth Creation. Only

Seven stocks in this study were hand-picked and conferred with this title.

However there were some other stocks that have been conferred with

"Potential 100 bagger Stocks" namely DCB Bank, Tata Elxsi, Aarti

Drugs, Shilpa Medicare, Suven Lifescience and Granules India.

About Atul Auto Ltd

Magnificent track record;

Shares of Atul auto Vs. BSE Index (SENSEX)

*CLICK IMAGE to enlarge

Numbers

to watch (As on 22/10/2016)

·

MARKET CAP (RS CR) ;

1,082.67

·

P/E; 23.90

·

BOOK VALUE (RS) ; 68.31

·

DIV (%) ; 105.00%

·

INDUSTRY P/E : 23.13

·

EPS (TTM) : 20.00

·

PRICE/BOOK : 7.00

·

DIV YIELD.(%) : 1.10%

·

FACE VALUE (RS) : 5.00

*Source: moneycontrol see latest numbers >>>

Atul Auto: Multiple triggers for growth potential;

1: Atul Auto is a Debt Fee Company.

2:

Its Promoter Holding is more than 50% and most investment funds are having

major share of Atul Auto, which indicates its multibagger potential.

Shareholding Pattern of Atul Auto Ltd

(in

%)

|

Sep-16

|

Jun-16

|

Mar-16

|

Promoter

|

52.70

|

52.70

|

52.70

|

Public

|

47.30

|

47.30

|

47.30

|

3:

Atul Auto with PE of 24 is keeping pace with Industry P/E 23 since everyone is

bullish on it so it exceeds the industry P/E ratio indicating good chances of

growing varied.

4:

Atul Auto The company management is confident to record double-digit growth in

the 2017 financial year.

5:

If you see the dividend payment patterns its consistently growing year-to-year,

signifying that the company is posting profit and is a very good sign in terms

of growth.

6.

Atul Auto’s trajectory of growth has been impressive with an ever increasing

volume.

7:

If you see the weekly charts it has been nicely consolidated and will

definitely be a good result in the future.

Experts’

advice on Atul Auto;

- Hold Atul Auto; target of Rs 505: ICICI Direct

- Accumulate Atul Auto; target of Rs 561: CD Equisearch

- Buy Atul Auto; target of Rs 537: Prabhudas Lilladher

Searches

related to ‘Atul Auto Multibagger Stock’

Atul

Auto multibagger stocks 2017 India, Atul Auto multibagger Indian stocks

for 2020, Atul Auto multibaggers, Atul Auto Share fundamental

analysis, Atul Auto multibagger stock ideas, 100 bagger stocks, hidden

gems, Best shares to invest 2016 to 2020. Atul auto growth potential.

Missed Buses;

Our Blockbuster recommendations;

Scrips

|

Reco date

|

Reco price

|

High

since reco

|

|

16th Jan, 2016

|

53

|

143

|

168%

|

|

25th Mar, 2016

|

273

|

420

|

54%

|

|

11th Dec, 2015

|

46

|

29

|

59%

|

|

16th Jan, 2016

|

35

|

53

|

51%

|

It is already a multibagger.

ReplyDeleteDo you believe it will become 100 bagger from here i.e. each share of Atul Auto will reach the price of Rs. 47,800 in long term? Hope you will answer to my query

ReplyDeleteGood article by admin and nice question by Madhu Sudan Acharya ji.

ReplyDelete