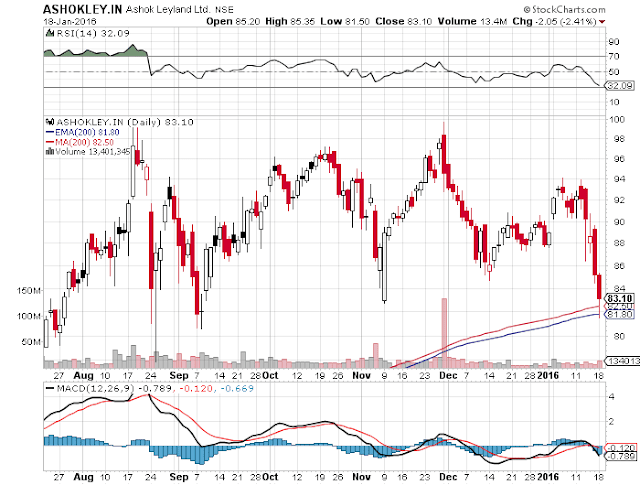

Can Ashok Leyland find support around current levels?

CMP Rs. 83.10 as on 18/01/2016

Trading Rule: Bullish stock has a tendency to hold long term moving average like 200 DMA

Popular Search Key Terms: Ashok Leyland Stock Target /Share prices, Ashok Leyland Live BSE/NSE, F&O Quote of Ashok Leyland with Historic price charts for NSE / BSE | Get Ashok Leyland Ltd. live share price, historical charts, volume, market capitalisation, market performance, reports and other company details Ashok Leyland future and option price, technical chart, news & announcements.

Ashok Leyland is at 200 dma

Is Ashok Leyland a Bullish stock?

Yes, Ashok Leyland made a large candle Bullish move earlier in Aug and Dec 2015. A large candle Bullish move has capacity to change the trajectory of the stock.

Has Ashok Leyland respected 200 dma post Bullish move?

Yes. Last time when Ashok Leyland was at 200 dma – the stock managed a strong bullish bounce from 83 to 99 in less than 12-15 trading sessions. The stock is now back to 200 DMA and technically, it should hold; if market turmoil does not affect it.

What If Ashok Leyland breaks 200 DMA?

There is also a possibility that stock can break 200 dma on closing basis and in the case the above rule will be considered failure. One must remember in market, we are dealing with probabilities and not certainties. Ashok Leyland on breakdown below 200 Daily Moving Average can become trendless to neutral. It then can slip to 81 and even to 78….where it has the most solid support.

[Update]

CMP Rs. 83.20 as on 12/02/2016

Amid market turmoil Ashok Leyland is again at it's 200DMA

As I have originally posted this article on 18/01/2016, it has been passed almost one month amid lots of devastation in stock market due to global turmoil. Here we will see how Ashok Leyland respected it's 200 moving average and reacted as per our expectation.

As per our analysis it respected it's 200 DMA at 82.50 and touched intraday high of rs 92.40 on 01/02/2016; almost 12% upside from its 200 DMA within 10-12 trading sessions. It has sustained at that level for few trading sessions but due to global market turmoil it has again fallen down to 81.10 (on 11/02/2016) and quickly bounced backed to 83.20 today on 12/02/2016. This time its 200 DMA is Rs. 83.83 so to the greater extend it has again respected its 200 DMA.

So I see a reversal trend in Ashok Leyland which may lead it to 92...95...97 again in few trading session, if it sustains at current level amid global sell off. As per above calculation one may make position with a stop loss at 81.

Disclosure: This post on "Can Ashok Leyland find support around current levels?" is purely for Educaitonal Purpose . Please do your own due diligence before trading or investment. Do not treat the above as any recommendation.

See what experts says on Ashok Leyland buying strategies;

- Feb 12, 2016

- Buy Ashok Leyland: Simi Bhaumik Feb 11, 2016

- Ashok Leyland Q3 net jumps over 6-fold to Rs 198.62 cr Nov 09, 2015

- Buy Ashok Leyland; target of Rs 105:Sharekhan

Popular Search Key Terms: Ashok Leyland Stock Target /Share prices, Ashok Leyland Live BSE/NSE, F&O Quote of Ashok Leyland with Historic price charts for NSE / BSE | Get Ashok Leyland Ltd. live share price, historical charts, volume, market capitalisation, market performance, reports and other company details Ashok Leyland future and option price, technical chart, news & announcements.

Similar Posts;

- How to trade with Moving Averages

- How to Play Intraday Trading Game

- Top 10 Low priced Stocks with Sound Fundamentals

- Trident Ltd: Value Investment in Small/Mid Cap

No comments:

Post a Comment