Hindustan Oil Set to Turn a Discovered Small Field (DSF-III) Success Story

HOEC is expected to start production from the block during the third quarter of the current financial year. The Company is seeing a ten-fold rise in the reserves based on the latest estimates.

The story of HOEC begins in 1983, when the great visionary, the Late Shri H.T. Parekh foresaw the need for a private stake in India's Oil & Gas sector. After over 3 decades, HOEC has now emerged as a fast growing independent E&P operator in India. HOEC now, through its operations, supplies 10,000 boe of products to the nation daily, across 4 of the 7 production basins in India. HOEC Ltd achieved it's success by adopting a low-cost rapid development model with a focus on local content, innovation and sustainable practices. HOEC aims to create long-term stakeholder value and ensures "grow responsibly".

Multiple keys to turn a Multibagger Stock

It is at a time when the majority of players, who won blocks under the DSF, are struggling to start production. A total of 54 contract areas were awarded in the first two rounds of DSF, out of which the DGH has received field development plans for 29 areas.

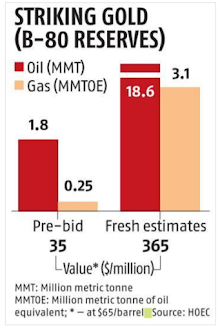

“We are seeing a multifold rise in the reserves based on the latest estimates. The pre-bid expected volume was around 1.8 million metric tonnne (MT) of oil and 0.25 million metric tonne of oil equivalent (MMTOE) gas. This has increased to 18.6 MT and 3.1 MMTOE now,” said P Elango, managing director (MD) of the company.

According to the company, with the rise in estimates, the value of reserves also increased from $35 million pre-bid to $365 million now (at a price of $65 a barrel). The company is investing $40 million in the block for two wells, in addition to four wells already drilled by the Oil and Natural Gas Corporation (ONGC).

“The reason for such increase is on account of post-development drilling, whereby HOEC revised the B80 three- dimensional geological model by applying all the data from the field, which include all the six wells,” he added.

B80 block in the Arabian Sea, off the Mumbai coast, had its first discovery by ONGC in 1987. HOEC won the block in September 2017, when the government came out with small field auctions to attract new investors to the sector. These were small oil and gas discoveries made by public sector undertaking oil companies, ONGC and Oil India (OIL). But these state-run companies could not develop it due to various reasons, including unviability, small size and restrictive fiscal regimes.

Though HOEC and Adbhoot Estates had equal stake in B80 initially, the Chennai-based company increased its stake to 60 per cent last year. The company had raised a Rs. 150-crore loan during that time for the acquisition and other project development works. The third round for which the government is scouting for investors includes 32 contract areas.

These comprise 75 discoveries, spread over 9 sedimentary basins covering an area of about 13,685 square kilometres. These blocks are expected to have a potential of approximately 232 million tonne. The government is set to conduct roadshows at overseas destinations like Perth, Singapore, Houston and London as well as domestic locations like New Delhi, Mumbai and Gandhi Nagar, said sources.

HOEC: Highlights

| |||||

| 52 Week High | 173.40 | ||||

| 52 Week Low | 60.35 |

| TTM EPS | 4.04 |

| TTM PE | 41.83 |

| Sector PE | 12.93 |

| Book Value Per Share | 55.44 |

| P/B | 3.05 |

| Face Value | 10 |

- Stock Price of HOEC is quoting at Rs. 150.90 at NSE on EOD 02-08-2021.

- Market Gurus believe that Hind Oil Exploration (HOEC) is still great buy after a decent rally in last week.

- Backed by lowest cost evacuation of crude the stock is poised to trade outside its chart territory.

- Glorious margins coming.

- If crude don't fall below 50 dollars, stock price is possible to give multibagger return to its stockholders in next two years.

Top Search keywords; HOEC;

hoec share price target, ongc share price, hoec share price nse, hindoilexp share price, hindustan oil exploration rakesh jhunjhunwala, hindustan oil share price forecast, hoec multibagger, hoec stock price latest news, hoec share price investment idea, hoec intraday price target, hoec hidden gem, hoec trading idea, hoec share price 52 week high low, hoec shareholding pattern, hoec stock ideas, hoec money n business, is hoec a multibagger stock.

Disclaimer; the above post is based on information available across internet, it is just a compilation of different reports. This post should be treated as an informational post only and it is not a buying call. Please consult your financial adviser before investing in the stock discussed in the post.

No comments:

Post a Comment